China now largest printer of notes

In the bank note printing game, one company rules them all: China Banknote Printing and Minting Corporation (CBPM). With well over 18,000 employees spread over 10 large, secure paper money…

In the bank note printing game, one company rules them all: China Banknote Printing and Minting Corporation (CBPM).

With well over 18,000 employees spread over 10 large, secure paper money factories, this state-owned operation is the biggest security printer in the world. In comparison, the U.S. Bureau of Engraving and Printing employs fewer than 2,000 staff at two currency facilities, while De La Rue has just over 3,000 employees.

Since 1984, CBPM has been concerned primarily with supplying currency for the country’s 1.4 billion population. But in recent years, that population has changed its habits. It has adopted electronic payments on a scale yet to be seen in other global economies. The arrival of smart phones has accelerated this process.

In 2016, The People’s Bank of China reported that only some 10 percent of China’s retail sales involved cash. The consequences have been simple. The Chinese people require far fewer paper yuan. This has left many staff and their sophisticated machines standing idle. One plant was reduced to producing marriage certificates and driver’s licenses.

For the Chinese government, the ability to print its own high-quality currency has long been a matter of national security. Its importance is ranked on par with the nation’s nuclear deterrent. Consequently, any suggestion of mothballing one or more of the 10 plants is not an option.

The solution was obvious: contract the unused services to other countries by printing their bank notes. In the security printing market, the Chinese have a distinct advantage. Their production costs are about half of those of large commercial printers, in large part because they are not concerned with making a profit.

An early August edition of the South China Morning Post makes it clear this competitive edge has meant contracts were not slow in coming. In this, the Chinese have been aided by the country’s Belt and Road Initiative. Several Asian countries, who were already on board this existing program, promptly saved millions of dollars by lodging their security printing requirements with China.

Nepal is a case in point. In 2016, it contracted for some 200 million 1,000-rupee notes (P-68 new signature). The results were excellent, with Nepal saving U.S. $3.76 million on the deal.

Other countries have signed printing contracts in the past couple of years. These include Thailand, Bangladesh, Sri Lanka, and Malaysia. From further afield, Brazil and Poland have come on board.

Having someone else print a national currency is a touchy subject. It is politically sensitive. It involves a security risk as well as national pride. Several of China’s customers asked the newspaper not to be identified.

And when the newspaper reported India had become a CBPM customer, this was strenuously denied by senior Indian politicians. A formal government statement reads: “Reports about any Chinese currency printing corporation getting any orders for printing Indian currency notes are totally baseless.” August editions of The Times of India make for interesting reading.

The upshot is that all of China’s printing plants are again running at near full capacity. But that international success comes with downsides. Stresses are beginning to show. All the new notes use rag paper technology, and China’s largest currency paper mill in the city of Baoding is struggling to keep pace with demand.

Among other matters, the process uses vast amounts of steam. This is supplied by a neighboring generating plant, but that mill’s power demands have reached a point where the city’s electricity supply is severely impacted.

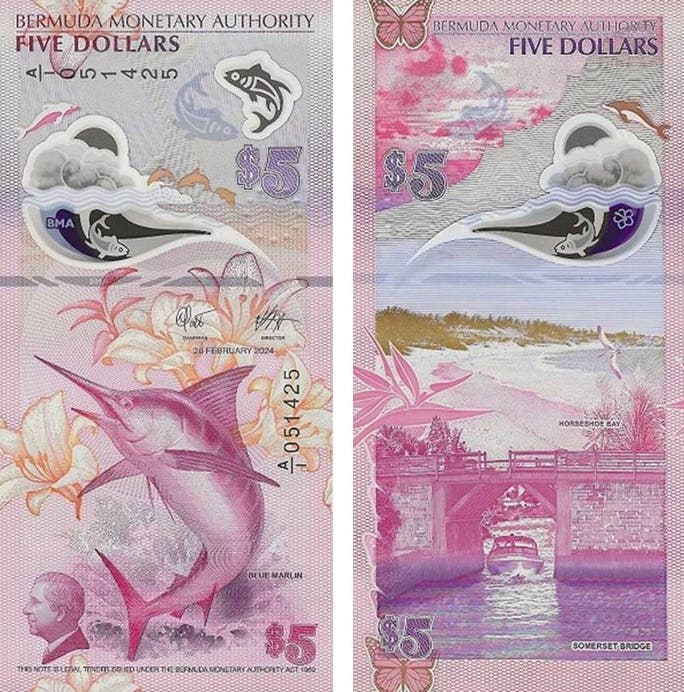

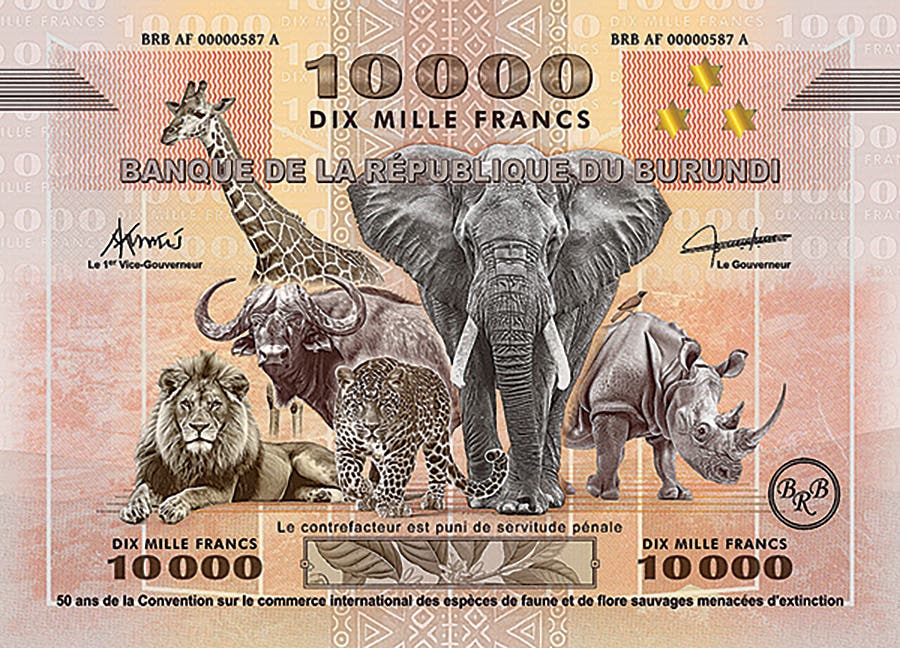

One of the major advantages of having China print a country’s notes is the ability of CBPM to provide security features at a fraction of the cost of other bank note printing houses.

Security costs are a major expense in bank note manufacture. Features such as embedded threads, metallic ribbons, and color-shifting inks have substantial license fees attached to their use. These fees can be sufficiently large as to limit the number of notes a country can afford to print. This is a relatively minor issue in notes sourced from China.

One of the CBPM’s subsidiaries, Zhongchao Special Security Technology, is recognized as the world’s largest supplier of bank note security features. De La Rue’s annual report acknowledges this firm has a third of the global market share, or four times that of its own.

In 2015, Zhongchao researchers won an international award for their ColorDance holographic feature. (Try Googling: “Colordance security feature”). This significantly increases paper currency security at relatively low cost.

While this all sounds fine and dandy, the one thing China has yet to offer is a durable secure polymer substrate. For tropical countries, this has become a must. However, it is probably only a matter of time.

This article was originally printed in Bank Note Reporter. >> Subscribe today.

If you like what you've read here, we invite you to visit our online bookstore to learn more about Standard Catalog of World Paper Money, Modern Issues, 1961-Present, 24th Edition.