De La Rue Fights to Turn Company Around

By Richard Giedroyc During early 2017 De La Rue stock was trading near the high point of its 52-week value. As of April 10 this year the stock was trading…

By Richard Giedroyc

During early 2017 De La Rue stock was trading near the high point of its 52-week value. As of April 10 this year the stock was trading at the paltry figure of 14.3 percent of its 52-week high as the stock tumbled to $1.47, down from $18.06 that is the current 52-week high.

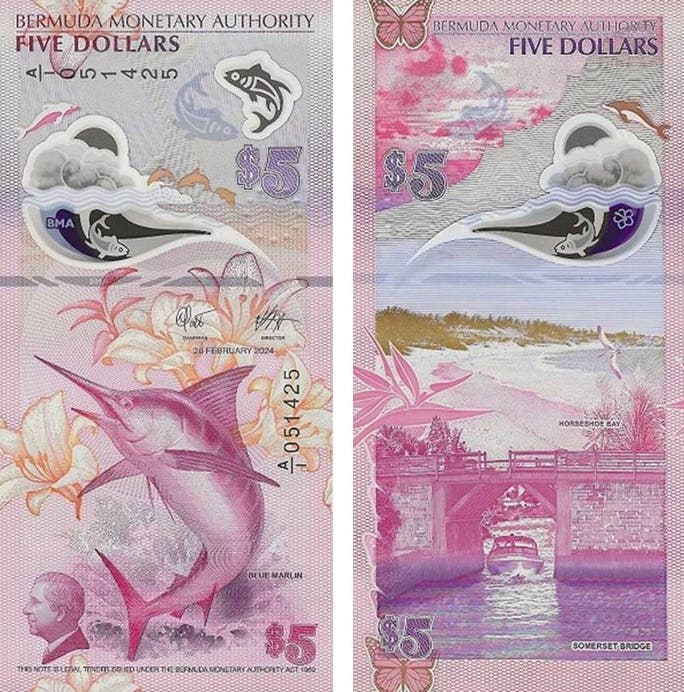

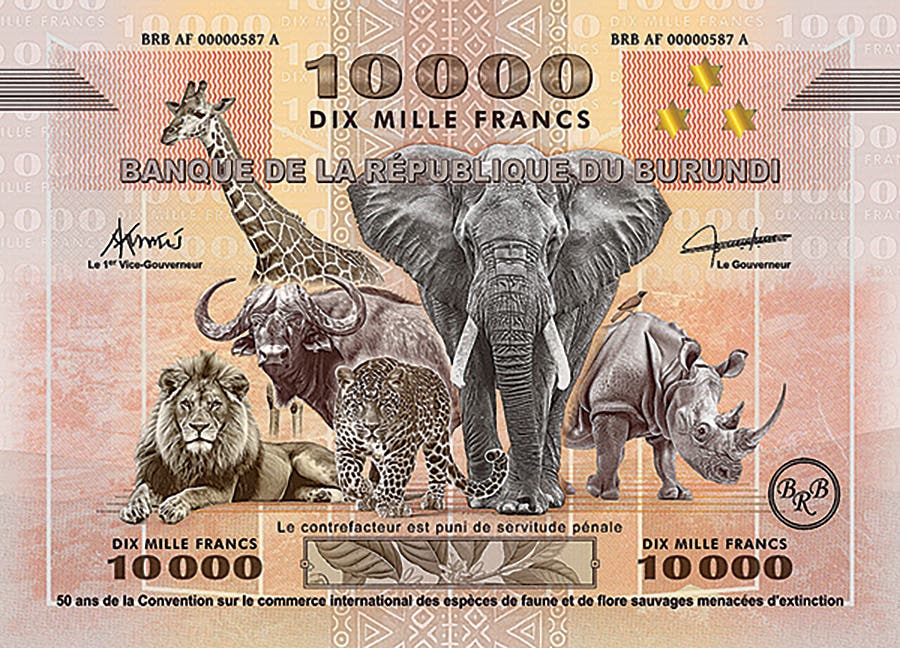

What is going on here? De La Rue PLC is ‘the’ household name in high-security paper and printing technology worldwide. The company produces bank notes for at least 69 countries. It is also responsible for producing bank checks, driver licenses, postage stamps, tax stamps, traveler’s checks, and vouchers.

Founded by Thomas de la Rue when de la Rue relocated from Guernsey to London in 1821, the company is today listed on the London Stock Exchange. (Peter Pugh traces the company between 1712 and 2003 in his 2011 book The Highest Perfection.) In that time the company that began as a London leghorn straw hat maker and stationer has morphed into the giant security printing business it is today.

De La Rue began printing playing cards in 1831. This was followed by printing postage stamps in 1855 and bank notes a year later. (The company’s first bank notes were printed for Mauritius.) What began as a family partnership was converted to a private company in 1896.

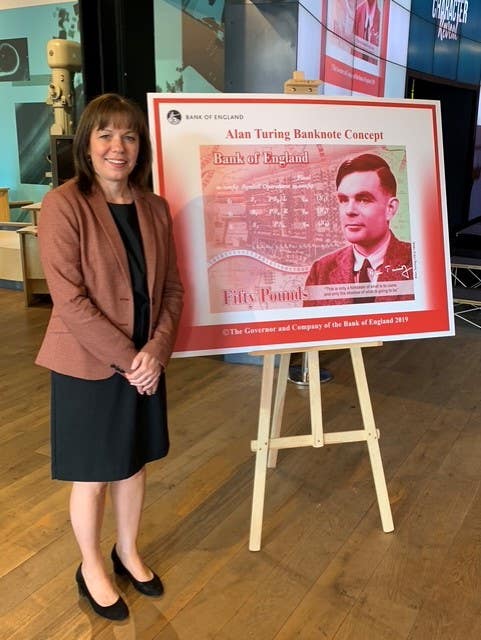

The company changed names several times during the 20th century. Some of these names include Thomas De La Rue and Company Limited, The De La Rue Company Limited and finally to De La Rue plc. De La Rue Giori is a joint venture in Switzerland between De La Rue Company Ltd. and the Italian printer and inventor Gualtiero Giori. Today, the company has an estimated 2,500 employees and produces an estimated third of all the bank notes circulating in the world. This includes the Bank of England’s recently released plastic composition currency.

On March 31 De La Rue announced a large drop in profits, predicting that adjusted operating profit for the 12-month period ending March 27 would be between £20 million and £25 million. Adjusted operating profits were more than £60 million one year earlier.

The March 31 Evening Express London newspaper reported, “The fall is largely due to business drying up in its currency arm in the first half of the financial year.”

In February De La Rue Chief Executive Officer Clive Vacher announced he would cut costs by about £35 million throughout the next three years, a change from a previous forecast of cutting £20 million during the same time frame.

On March 31 Vacher indicated the net debt at the end of the financial year 2019-2020 was expected to be £105 million, a reduction of more than £65 million from six months earlier.

In a statement to shareholders, Vacher said, “The group is progressing well with its turnaround plan announced on 25 February. The company is monitoring developments related to Covid-19 and actively taking steps to protect its employees in line with guidance from governments. At present, it is too early to quantify the potential impact on the 2020-2021 financial year.”

The question now is if and how the company plans to turn itself around. It would create an enormous vacuum if De La Rue were to stop producing bank notes.

TheApril 20 issue of Simply Wall Street said, “According to my price multiple model, which makes a comparison between the company’s price-to-earnings ratio and the industry average, the stock price seems to be justified,” adding the optimistic view, “De La Rue’s earnings over the next few years are expected to double.”

There is little doubt the company is making changes. In 2016 De La Rue sold Cash Processing Systems, its cash handling division to Privet Capital. Later the same year it purchased the DuPont Authentication division to support polymer bank notes De La Rue was producing for Great Britain. In 2018 the company sold 90 percent of its paper business. The same year it lost a contract through which it had been printing passports for the British government. In 2019 De La Rue sold its identity solutions business to HID Global.

For more news like this, subscribe to World Coin News.

As an Amazon Associate, Numismaticnews.net earns from qualifying purchases made through affiliate links.