The Demise of Checks is at Hand

The use of physical cash has declined in recent years, but who would expect checks, rather than coins and bank notes, to go extinct due to the rise of cashlessness?

When someone uses the term ‘cashless society,’ we think of the demise of coins and bank notes. The use of physical cash has declined in recent years, but who would expect the check rather than coins and bank notes to go extinct due to the rise of cashlessness?

According to a Reserve Bank of Australia 2022 survey, transactions involving paper checks make up a mere 0.2 percent of all financial transactions. Consumer payments using checks were half of this figure. The Australian Banking Association indicated paying by check has declined by about 90 percent over the past 10 years.

At the same time, banks now spend more than $5 to process a check. The Australian Treasurer’s office said this fee will increase as the number of checks being written continues to decline.

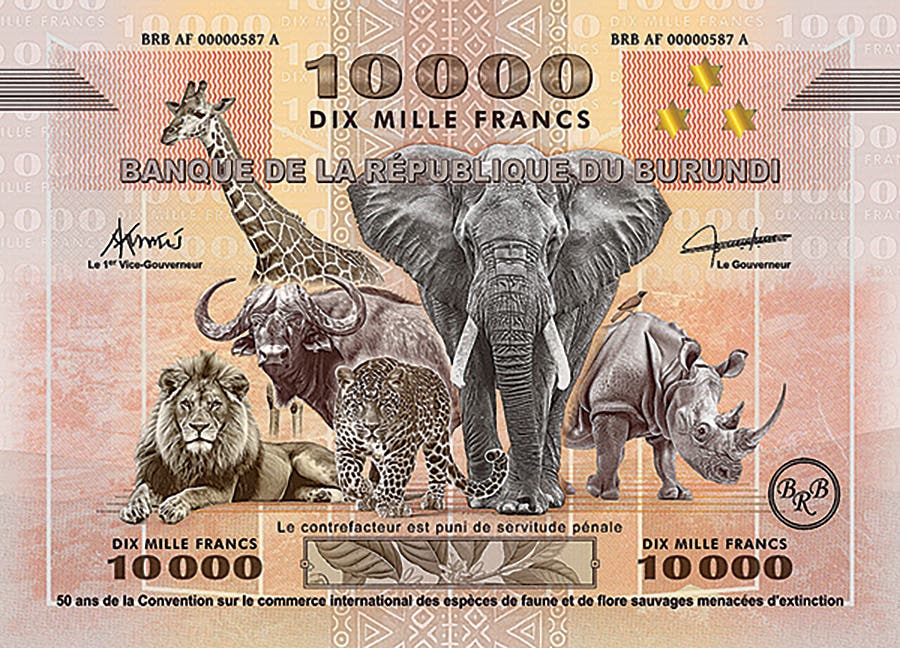

At the same time, the Reserve Bank of Australia said, “The share of bank notes used for transactional purposes is estimated to have fallen by five percentage points since early 2020, while cash use in the shadow economy has increased slightly and the proportion of bank notes that are lost has remained unchanged. Overall, the majority of bank notes on issue are currently used for non-transactional purposes, consistent with pre-pandemic trends.”

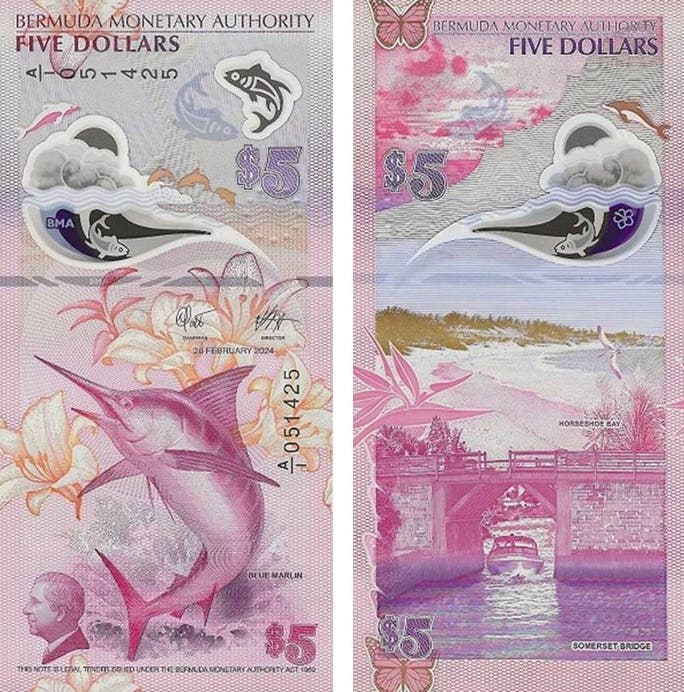

“Growth in low-denomination bank notes ($5, $10, and $20) has been slow, increasing at around one percent annualized on a per capita basis since 2007. Low denominations are typically used for in-person transactions and for merchants to provide change, so subdued demand for these bank notes indicates a reduced use of cash for consumer spending. By contrast, demand for high-denomination bank notes ($50 and $100) has been strong and the key driver of growth in overall banknote demand; high denominations have grown by almost five percent on an annualized per capita basis since 2007.”

While the central bank can calculate reliable statistics on check use, transactional demand for bank notes and coins can’t be directly observed or measured.

Ironically, while Australia still sees a need for physical cash, the government intends to terminate check usage by the end of 2028 and then phase out checks entirely by 2030. In 2023, the Australian government released the “Strategic Plan for the Future of Australia’s Payment System.” The report considers checks to be redundant. Banks have stopped issuing checkbooks to new customers. Many merchants have stopped accepting checks. The same is not true when people choose to pay in cash.

During a 2023 conference, Australian Banking Association Treasurer Jim Chalmers said, “This transition will be gradual, coordinated, and inclusive. There will be public consultation on the transition, including with the states and territories, before the end of this year.”

Phasing out checks in Australia won’t be easy. National Seniors Australia CEO Chris Grice describes checks as being the “canary in the coal mine” of a society moving towards a cashless society. Grice said, “Any society can embrace change, but you’ve always got to bring everybody with you, and the concern is we’re leaving a cohort behind by racing towards this digital economy,” continuing, “It would be good to see a number of banks across the country start to really look at their customers that have been customers for 40, 50, 60 years.”

“The banks have got to really make sure that as a system they are providing support to the entire community, not just the cohort that have mortgages.”

Australia is not alone in reconsidering the use of handwritten checks. The Reserve Bank of Philadelphia has predicted paper checks will be obsolete in the United States by 2026. Bill paying online or by telephone is increasingly being encouraged. Electronic checking has a lower risk of fraud. A recent survey suggested 46 percent of Americans didn’t write a check during 2023.

While this may sound bleak, checking accounts will likely continue since they are the foundation of personal banking. Transactions to and from these accounts will simply be made electronically rather than by the time-honored handwritten paper check.

Electronic forms of payment are a modern substitute for physical cash. These join checks, debit, and credit cards as substitutes but not as a permanent replacement.

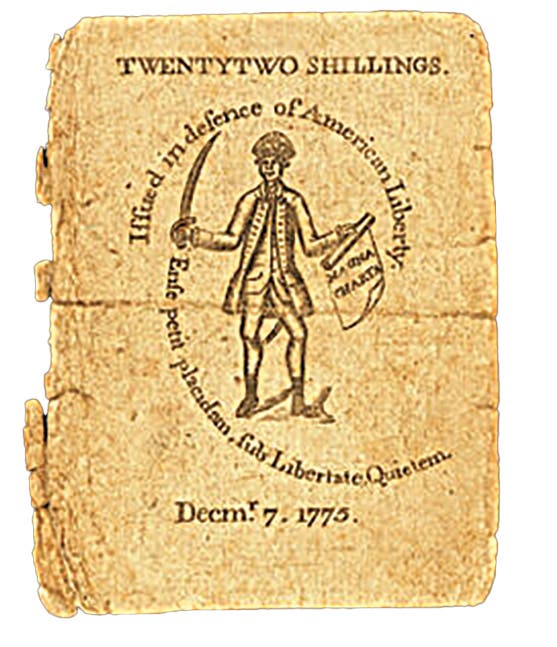

Checks appear to have originated as ancient Roman praescriptiones. Checks gained popularity among Muslim merchants during the ninth century. These traders invented the sakk, a paper document instructing a merchant’s bank to make a payment from that merchant’s account. The sakk was safer than carrying large amounts of physical coins. Checks came into use in Europe during the 15th century and during the late 17th century in the United States.

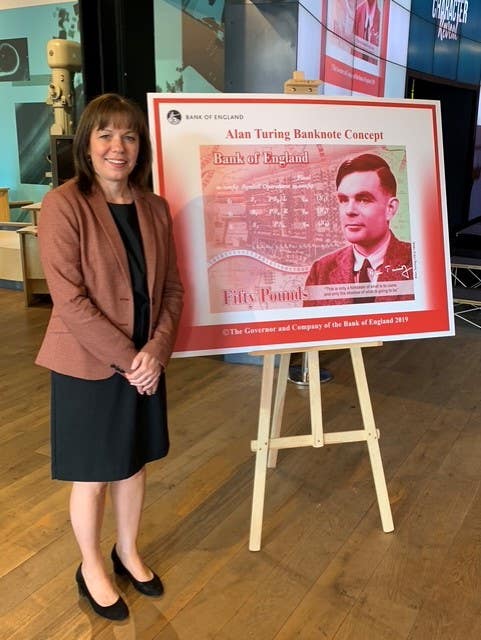

The British banker Lawrence Childs introduced the first printed checks in 1762. Childs included serial numbers for bookkeeping purposes. Before that, checks were written by hand.

The largest amount ever paid out by a written check is allegedly for $9 billion paid by the Japanese investment bank Mitsubishi to Morgan Stanley. The reasoning behind writing a check this large was that the transaction needed to be made on Columbus Day, a banking holiday in the United States.

Check writing reached its zenith in the early 1950s in the United States. At that time, more than 28 million checks were written daily, equating to about one in every six Americans writing a check every day.

Check collecting is generally accepted to be a branch of bank note collecting. Many checks are collected because of the name of the bank on which they are drawn, vignettes that appear on the checks, or because of the signature that appears on the check.

You may also like: