The Road to Polymer Bank Notes

Polymer bank notes are gaining traction for their durability, cleanliness, and resistance to counterfeiting.

Polymer bank notes are gradually replacing traditional paper notes. Made from a synthetic polymer, these bank notes last significantly longer than paper, at least 2.5 times as long, according to some experts, thereby reducing environmental impact and production costs. Polymer bank notes are also cleaner than their paper counterparts because they are waterproof and resistant to dirt and moisture. Most importantly, they are much harder to counterfeit.

Polymer bank notes are not exempt from criticism as they are harder to fold, and, in some cases, the colors applied to the polymeric support have been found to fade. In August 2012, Nigeria’s Central Bank planned to switch from polymer to paper notes after finding significant difficulties associated with the processing and destruction of the former. The plan never materialized, though. In any case, new technologies and materials will eventually solve these technical problems and enable a smooth transition to polymer paper money.

Here is a brief history that recounts the most important events that paved the way for the current use of polymer bank notes.

The Tyvek Bank Notes

In 1955, Jim White, a plastics researcher from the American multinational chemical company DuPont, by chance discovered a new type of polymeric material that was later called Tyvek. It consists of a spun-bonded material made from high-density polyethylene fibers. Tyvek’s properties make it hard to tear but easy to cut, waterproof, recyclable, and paper-like. All these qualities make it an ideal candidate for banknote use. A patent application was filed in 1956 to protect strong yarn linear polyethylene materials, including Tyvek.

Bank notes made of Tyvek were subsequently printed in the early 1980s by the American Bank Note Company for three countries: Haiti, Costa Rica, and the Isle of Man. In 1980, Haiti released its Tyvek notes in denominations of 1, 2, 5, 50, 100, 250 and 500 gourdes. In 1983, Costa Rica and the Isle of Man put in circulation bank notes of 20 colones and one pound, respectively. Technically speaking, these were the first polymer bank notes that ever circulated, although they were still being tested.

Despite the initial expectation, Tyvek did not perform well in these bank note trials. The ink would smudge in hot and humid climates, and fragility also posed problems. As a result, the production and use of Tyvek bank notes was discontinued a few years later. Despite that, Tyvek is still used nowadays for various applications, including shipping mailers and manufacturing sterile covers for pharmaceuticals and perishables.

The DuraNote Test Bank Notes

A combined project was launched at the beginning of the 1980s by the Canadian engineering company AGRA Vadeko and the American Mobil Chemical Company to develop a polymer that could be used in various applications, including producing paper money. The result was the production of Duranote. The polymer note was made of 21 ultra-thin layers of an optically oriented polypropylene film, adhesive, and coating layers with printable surfaces. It was said to last four times longer than conventional paper-printed notes and remain crisp and clean for longer. It further incorporated an array of security features embedded within the polymeric layers. Nearly 30 countries and authorities (including the American Bureau of Engraving and Printing) prepared and examined test notes using their regular bank note printing plates. The trials were not, however, successful, and the project was abandoned towards the end of the 1990s. The patents for Duranote were sold following the Exxon-Mobil merger in 1999.

And the Australians got it right!

Australia transitioned from the pound to the dollar on February 14, 1966 (“Decimal Day”). By April of that year, most of the old imperial bank notes had been removed from circulation, and the brand-new paper money, following the decimal system, was circulating nationwide. However, soon counterfeits started to appear, leading to unrest among the population and the authorities. In reply, the Governor of the Reserve Bank of Australia (RBA), Herbert Cole Coombs, requested the Australian Commonwealth Scientific and Industrial Research Organization (CSIRO) to produce a bank note that was hard to counterfeit.

After some years of research, the first patent application, “Improvements in or relating to Security Tokens,” was filed with the Australian Patent Office on September 26, 1973. CSIRO was named the applicant, and S. D. Hamann and D. H. Solomon were among the inventors. The invention underlying the patent concerned the production of bank notes, credit cards, and similar security tokens in a way that prevented forgery. To achieve that, the inventors proposed to incorporate plastic supports optically variable devices (OVDs) with a distinctive appearance that could not be satisfactorily reproduced when photocopied or photographed. At least one of such optical devices would be embedded between two layers of plastic that were intimately bonded together. Also proposed as an extra security measure was the presence of “transparent windows” that allowed to see through the notes. The corresponding patent, 488,652, was granted by the Australian Patent Office on November 18, 1977.

Several patent applications protecting further improvements were filed within the first ten years of the project launch. Of particular relevance were the improved OVDs containing a figure that changed in appearance according to the angle of view or with light, which was to become a key anti-counterfeit element in future bank notes. An optically oriented polypropylene film was chosen as polymer support. While the technology was ready earlier, delays attributed to the decision-making bodies prevented the issue of the notes until 1988.

Finally, in January 1988, the first polymer note entered circulation in Australia. It was an AU$10 bill that commemorated Australia’s bicentennial year marked by the establishment of the New South Wales colony in Sydney Cove. The nominal value of this first bank note was not randomly chosen. It reminded of the Australian $10 paper note that, after being launched on “Decimal Date,” began to be forged and triggered the creation of polymeric notes. The obverse of the AU$10 polymer note features an image of a sailing ship in Sidney Cove with rows of settlers in the background. On the reverse side is an image of an Aboriginal boy in body paint with a background comprising rock paintings and a ceremonial Barnumbirr pole. The success of the Australian $10 bank note of 1988 was immediate, and it soon became the industry standard for future polymer bank notes across the world.

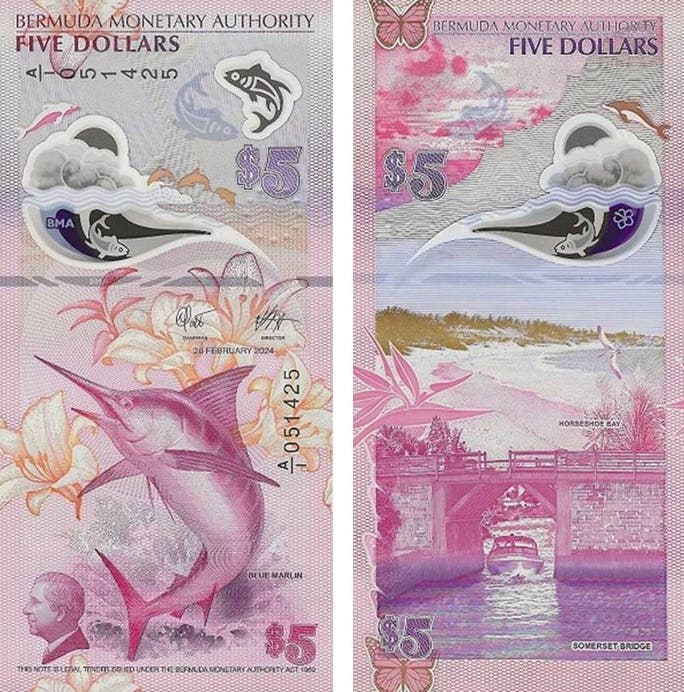

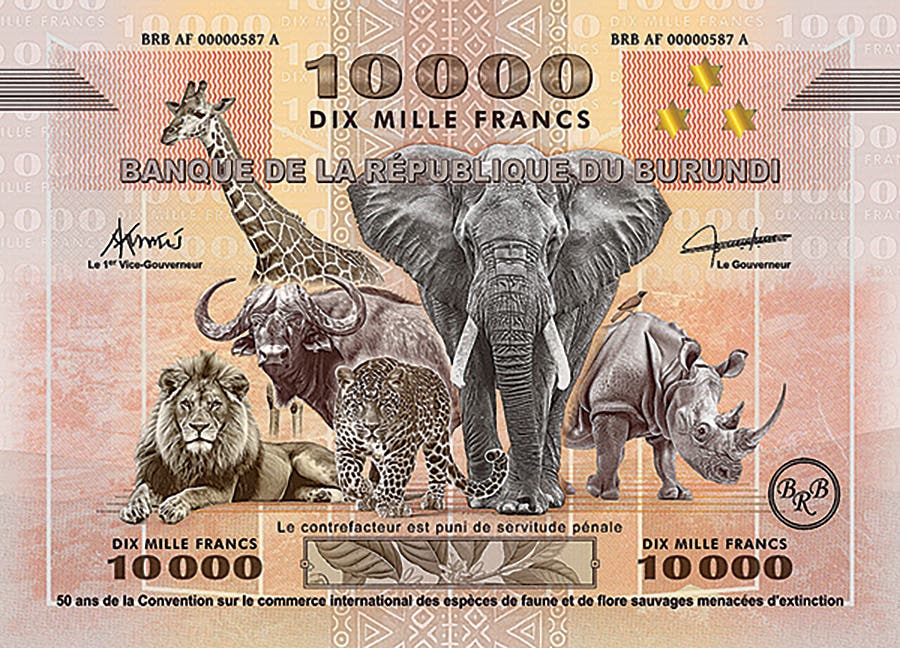

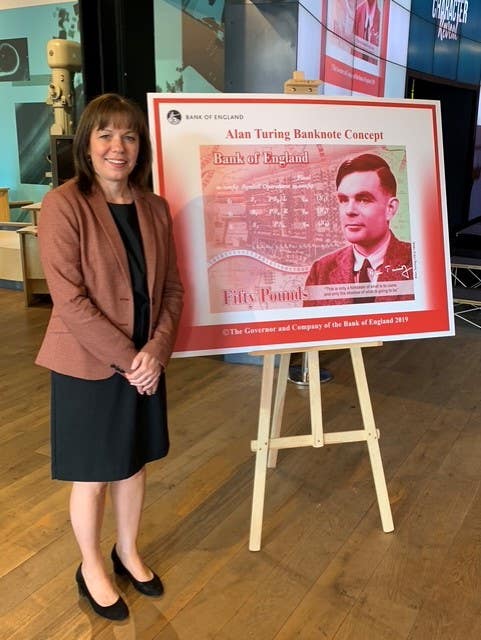

New technological improvements are continuously being made and implemented in polymer bank notes. More than 45 countries use these, and the number is constantly growing. It is expected that by 2030, another 20 countries will abandon the use of paper bank notes and switch to polymer.

You may also like: