Demand for Collector Coins Holds Strong

The demand for both collectible and intrinsically impacted coins doesn’t seem to be pausing, even to come up for air. While there have been recent gyrations in the spot price…

The demand for both collectible and intrinsically impacted coins doesn’t seem to be pausing, even to come up for air. While there have been recent gyrations in the spot price of gold, silver and yes, even copper, none of this appears to be slowing the demand for collectible coins, which for the most part continues to outstrip supplies. This isn’t just the market for bullion American Eagle coins, but the demand continues for the new Mint issues, for 1964 and earlier circulation strike gold and silver coins, and just about anything collectible.

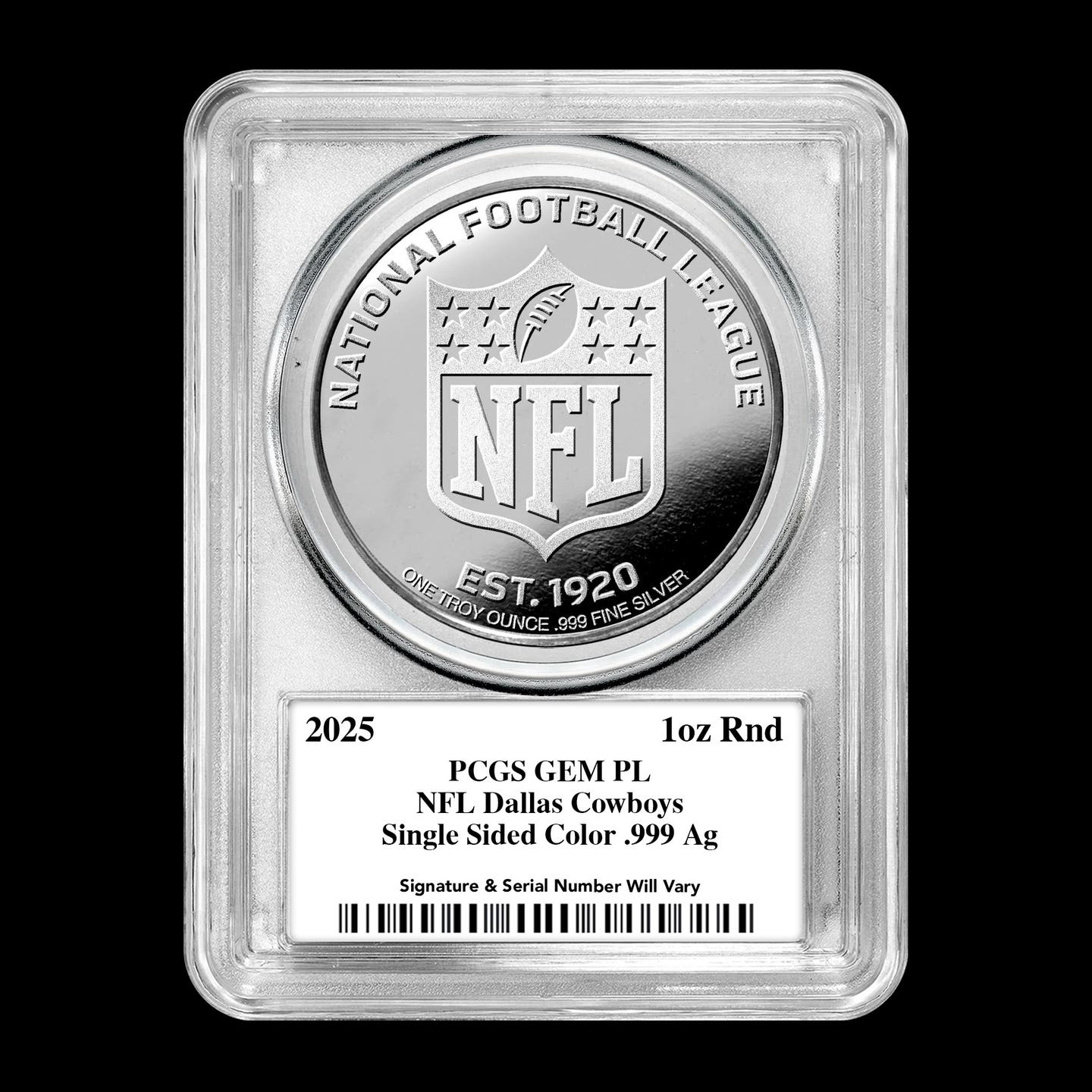

You might think made-for-collector, non-circulating legal tender coins produced by the U.S. Mint would be a weak spot in this otherwise frothy market, but even here there is much interest not only in an initial issue, but once these coins hit the secondary market as well.

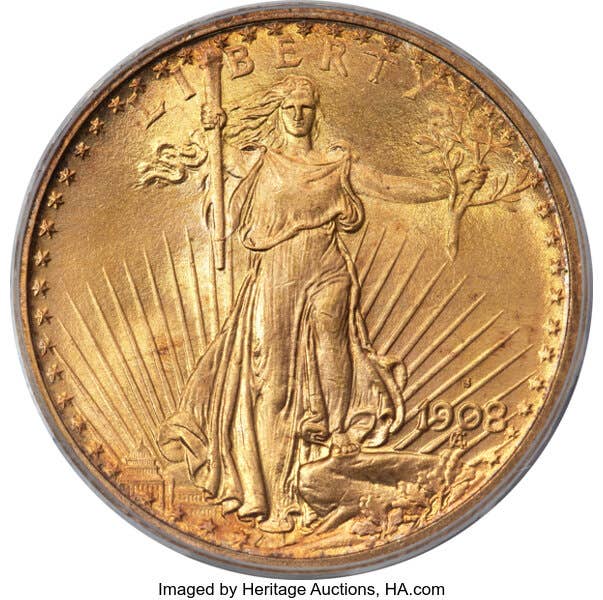

All sectors continue to perform well. It is true the spot price of gold and silver bullion has struggled, especially in the key bullion jewelry market in India. Not so regarding coins in the United States. At the same time, the scarce to rare coin market is about to witness the sale of some extremely rare Civil War period gold coins in early December, this selection being highlighted by an 1861-O Coronet $20 double eagle.

The interest in all market sectors at the same time is important since bullion and Mint products are typically an entry point for beginners, while more advanced collectors are more likely to participate in the scarce to rare areas. Overall, the market continues to be strong.