Gold coins now hitting melting pot

It has been common practice for years for coin dealers to melt common date U.S. and foreign silver coins for their intrinsic value rather than offer them to retail clients….

It has been common practice for years for coin dealers to melt common date U.S. and foreign silver coins for their intrinsic value rather than offer them to retail clients. U.S. dealers are now considering melting more common date gold coins as well, especially since the premiums on many of these coins make it less attractive to take the time to seek out collectors willing to buy them for a pittance more.

The practice already exists in Europe. Richard Lobel is the owner of CoinCraft in London, England, a shop situated directly across the street from the British Museum.

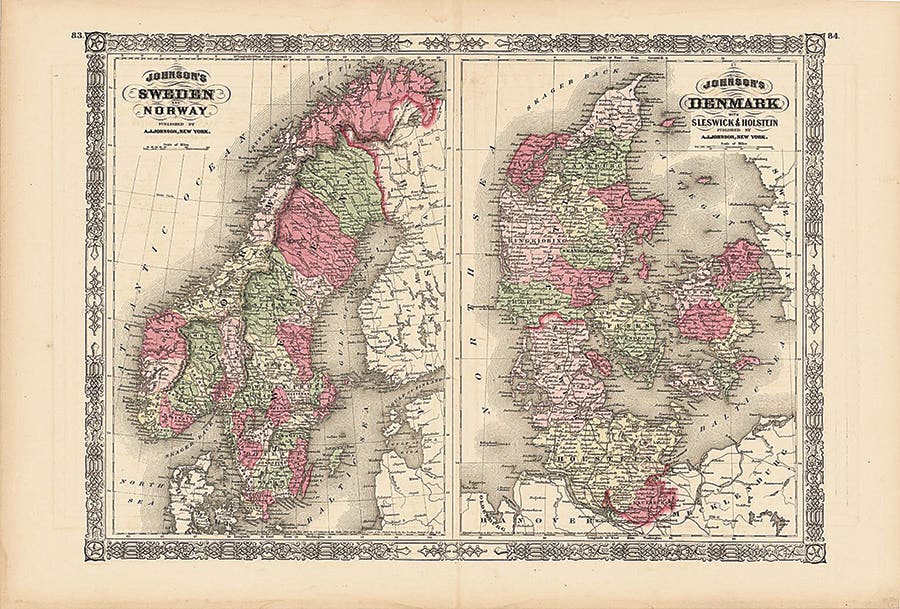

“The market for modern gold is very close to their bullion value,” said Lobel. “[British] sovereigns can be bought for two percent over melt. [British] Royal Mint gold proofs can be had for five to seven percent. Many of the world coins are being melted because they [coin dealers] can get 98 percent of gold value.”

Lobel continued, “With the price of gold being so high it is impossible to sell many of the common gold coins. I was even offered by a Spanish dealer the 1915/1916 Cuban gold in Extremely Fine at gold plus five percent. British sovereigns and Britannias are the most wanted in this country. There is no VAT [Value Added Tax] on them and no capital gains tax on them at the moment. A lot of the French, Belgium and Austrian coins are being melted. Any British coin that has been mounted is almost always going into the pot.”

Fairfield, Conn., foreign coin dealer Allen G. Berman added, “Over the years collectors have become more and more picky about grade. It is not surprising for collectors who know a certain coin is often available in Very Fine to Brilliant Uncirculated to systematically avoid purchasing the same coin below VF. With very common European gold, such as 10 and 20 francs, the difference in cost between Fine and Extremely Fine may be as little as two or three percent. Thus the collector, and even the small bullion investor, has no motivation to buy the lower grade coin. If there is [a] retail market, fewer pieces will be held out of the melt. I am disturbed at some of what I have seen melted recently.”

New York dealer Andrew “Andy” Lustig said, “…When you consider the historically low premiums on U.S. gold, it’s hardly surprising that some foreign gold is getting melted.”

According to the Sept. 23 Coin Dealer Weekly, or “Greysheet,” “Multiple market participants have commented to us that premiums for the commonly traded world gold coins: [British] sovereigns, [French 20-franc] roosters, Swiss Vrenelis (20 francs) etceteras – have fallen to historically low levels because of a supply glut versus demand … Circulated [$10] Eagles and [$20] Double Eagles are trading virtually at melt, sometimes even back of melt, and premiums for Mint State coins are near historic lows. We have also heard rumors of an enormous hoard of physical gold coins in Europe, consisting of U.S. and European coins, that is weighing heavily on (over)supply.”

According to the U.S. Mint, it is not illegal to deface a coin unless you intend to commit fraud due to that defacement. It is only illegal to melt U.S. cents and 5-cent “nickel” coins for profit.

It is illegal to melt a legal tender Canadian coin in Canada. Once the coin has been exported, the Canadian government no longer has jurisdiction.

The laws regarding scrapping domestic coins for profit vary from country to country, but Canada appears to practice a double standard. During 2015 the Bank of Canada ordered 215,000 $5 and $10 gold coins dating from the 1930s to be melted to help balance the federal budget and avoid raising taxes.

Leon Hendrickson of SilverTowne was interviewed in a Jan. 19, 1999, article written by Ed Reiter. In that article Hendrickson noted his company was responsible for the melting of “thousands of bags” of silver coins. Hendrickson acknowledged he began this process during the 1960s.

Within the Reiter article Hendrickson said that while the melting made the losses permanent, the physical withdrawal already had caused the hobby grievous harm. Hendrickson told Reiter, “The collectors that are left pretty near have to go to a type set. Losing all those coins killed date- and-mint collecting; it just eliminated the man who was building a complete collection.”

Should U.S. gold coins become commonly relegated to the melting pot, it wouldn’t be the first time in modern history – sort of. In 1984 J. Aaron and Company melted 10,000 Mark Twain American Arts gold medallions in one stroke, this being more than six percent of the total minted. Who knows how many more may have followed. These may not have been coins, but they are U.S. Mint products.

On Aug. 22 Bloomberg news service reported British scrap gold refiner Baird & Company “un-mothballed” part of its 20-ton a year refining plant in London.

“When prices were lower, we struggled to get enough material to meet demand,” Tony Dobra, Baird executive director, told Bloomberg. “Now we’re seeing double the volume we did a year ago.”

The Bloomberg article pointed out that more than a third of the world’s gold bullion supply comes from recycled metal. That includes a lot of coins.

This article was originally printed in World Coin News. >> Subscribe today.

More Collecting Resources

• Purchase your copy of The Essential Guide to Investing in Precious Metals today to get started on making all the right investing decisions.

• Download The Metal Mania Seminar with David Harper to learn more about the metals market.