Mints to Hold Conference in Canada

Readily accessible cash is critical to the ability of societies to go about their daily lives, according to the International Mint Directors Association. The IMDA and the International Mint Directors…

Readily accessible cash is critical to the ability of societies to go about their daily lives, according to the International Mint Directors Association.

The IMDA and the International Mint Directors Network will gather more than 300 delegates from the minting and related industries to discuss the future of circulation coins, collector coins and bullion on October 15-18 in Canada. It is the first time in five years the Mint Directors Conference will be held.

Looking ahead a Foundation of International Mint Industry Association statement reads, “2022 closes with a world economy struggling to deal with heightened geopolitical uncertainty and with growth rates for 2023 at best challenged and potentially in decline. The inflation ‘genie’, generally under control over the past decade or so, is now out of the bottle and as central banks attempt to reign it in, the impact of a rapidly increasing interest rate response is placing households and consumers under serious strain.” The FIMIA was established as the successor to the Mint Directors Conference in June 2022, the former organization having been founded in 1962.

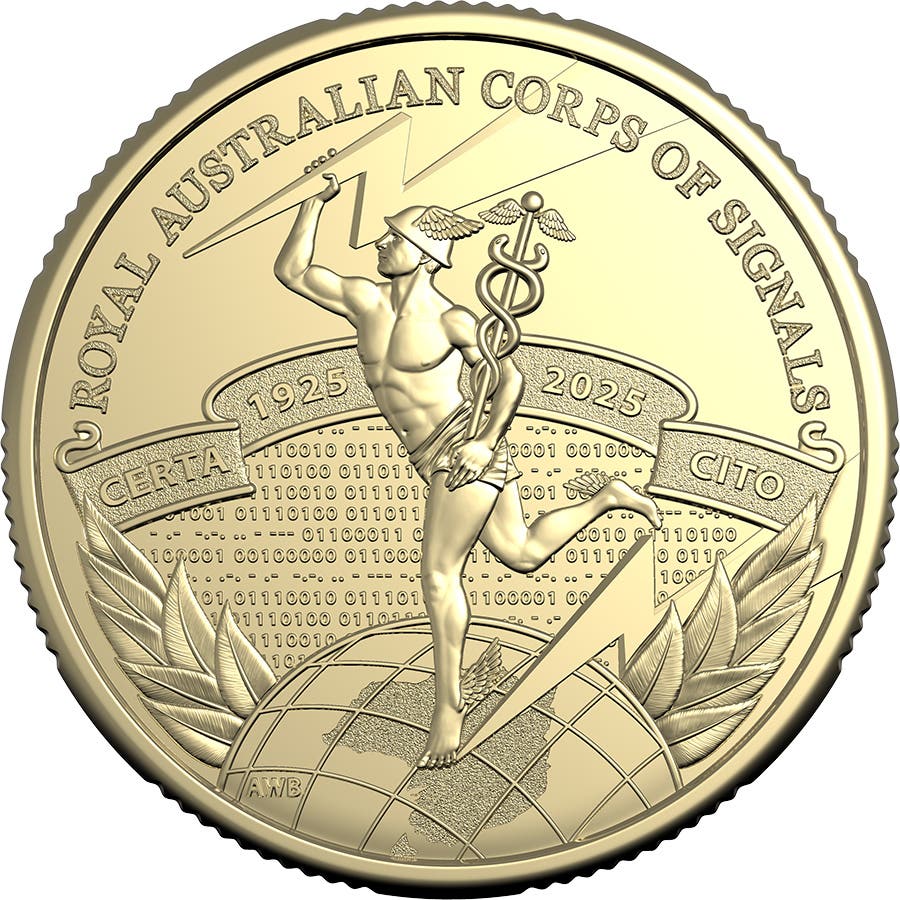

The founding members of the IMDA are the Royal Australian Mint, Austrian Mint, Royal Canadian Mint, Croatian Mint, Czech Mint, Monnaie de Paris, State Mints of Baden-Wuerttemberg, Bavarian State Mint, Hungarian Mint, Japan Mint, Kazakhstan Mint, Korean Minting and Security Printing Corporation (OMSCO), Singapore Mint, Mincovna Kremnica, South African Mint, Royal Spanish Mint, Swiss Mint, Royal Mint United Kingdom, and the U.S. Mint.

The original organization was comprised of the directors of Western European mints in Austria, Belgium, Finland, France, Netherlands, Norway, Spain, Sweden, Switzerland and the United Kingdom.

MDC 2023 will be hosted by the Royal Canadian Mint in Ottawa. According to the organization, delegates from the minting and related industries will discuss the future of circulation coins, collector coins and bullion, and the industry’s contribution to the sustainability agenda.

Some of the topics scheduled for the MDC include the role of cash in an increasing digital payment environment, the contribution of mints to the sustainability agenda, if the coexistence of physical cash and digital currencies are “myth or reality,” new trends in numismatics that could increase revenues, rethinking “the numismatic ecosystem,” how to engage the younger generation, the bullion market and associated collectible coin boundaries, and addressing “as an industry, where will we be in 10 years’ time… and more importantly is this where we want to be?”

According to the IMDA, “A question that is often asked, besides what will happen to low utility / low value coins, is how long will cash be in existence in this rapidly digitalizing world. The typical response is that as long as there are consumers in society who are socially and economically disadvantaged, or are elderly, or have a mistrust of technology, or are fearful of loss of privacy, or are just unwilling to change because of tradition and culture, then cash and coins will continue to be used and therefore in demand.”

“That would suggest cash will continue to be a medium of exchange, particularly for small value transactions, for a considerable time into the future. Given that 17 percent of the world remains unbanked, perhaps it will be decades.”

The MDC-Technical Committee met on Nov. 5-6, 2022 in Singapore. A statement released following that meeting reads, “While digital is becoming a growing part of the monetary transacting system, we are being faced with constant reminders that in certain situations – and not only with particular cohorts of the population – readily accessible cash is critical to the ability of societies to go about their daily lives. Cash can and will play its part in helping to provide solutions in a crisis.”