Philippines Not Issuing 100-Peso Coins

The currency system of the Philippines has been through numerous challenges recently. Among these challenges are to keep sufficient coins and bank notes in circulation, to promote the digitalization of…

The currency system of the Philippines has been through numerous challenges recently. Among these challenges are to keep sufficient coins and bank notes in circulation, to promote the digitalization of transactions, and now to make the public understand the central bank is not withdrawing the 100-peso bank note in favor of a coin.

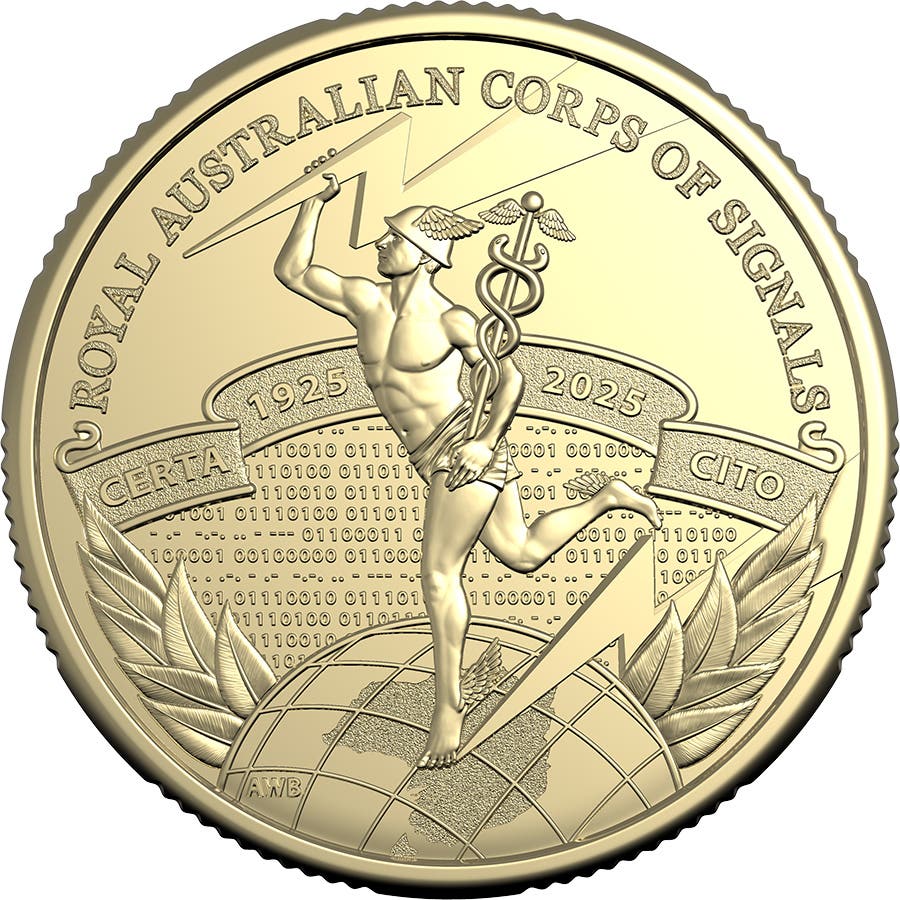

According to a Bangko Sentral ng Pilipinas or Central Bank of the Philippines statement, “The [untruthful] social media posts used the image of an old 100-piso commemorative coin that the BSP issued in 2017 for the 100th founding anniversary of Muntinlupa City.”

Adding to this confusion, there have been false social media posts recently that claim the Philippines has issued a new 5,000-peso bank note. These media posts depict a digitally altered video of a commemorative note that was issued in January 2021. The Philippines does not use bank notes in denominations higher than 1,000 pesos.

Commemorative coins and bank notes are legal tender unless they have been demonetized by the central bank. Some of the recent errant social media clips are titled “Presentation of New Philippine Bank Notes and Complete Set of New Generation Currency Series Coins.”

Potential shortages of coins and bank notes has challenged the Philippines central bank in recent years. The demand for new coins and bank notes surged in December 2022 due to the demand for pristine examples to be used for the traditional “Aguinaldo” gifts of cash to friends and family.

According to a Dec. 17, 2022 central bank statement, “Denominations with the highest demand during this period are the 1000-, 100-, and 50-piso bank notes; and 20-piso, 1-piso, and 25-sentimo coins.”

The bank is encouraging people to use digital money by sending “e-aguinaldo” as holiday cash gifts. The Mindanao regional BSP office has been encouraging the public to swap worn coins and bank notes for e-money rather than more cash. This e-Cash in Points initiative is in line with the central bank’s efforts to safeguard the integrity of Philippine currency and to promote the digitalization of transactions in the country. Campaigns to promote digital financial literacy and cashless payments are planned for the future.

The Paleng-QR Ph is a joint initiative of the central bank and the Department of the Interior and Local Government that is planned to allow the use of digital payments in public markets and public transportation services. The program was initiated in Baguio City in August 2022 and will be expanded throughout Davao City during 2023.

At the recent launch BSP Governor Felipe M. Medalla said, “I’m honored to be here today as we launch the Paleng-QR Ph program in Davao City, which will hopefully be the launch pad [to expand cashless payments] for the rest of Mindanao. We have to start where the chances of success are greatest.”

The BSP has been juggling a balancing act in recent years to ensure there is sufficient coinage and bank notes in circulation. In October 2022 Federation of Free Farmers Chairman Leonardo Montemayor complained when the BSP began printing polymer rather than abaca composition bank notes in an effort to stay ahead of the curve regarding worn out bank notes.

Montemayor said, “This has an impact in terms of our poverty picture – availability of jobs, income for rural residents, and, in addition to that, it’s the psychological impact. Our farmers feel that the abaca industry, which the Philippines has always been proud of, is now being belittled.”

Referencing Section 12, Article 12 of the 1987 Constitution in response to Montemayor’s complaint BSP Senior Assistant Governor and General Counsel Elmore Capule said, “We have to realize that constitutional provisions are not self-executory…As far as the BSP is concerned, we are cognizant of these provisions. Meaning, we cannot just make a decision based on, let’s say, a particular sector or industry. We look at the entire economy, the entire impact, and the savings, which is good for all.”

Between October 2021 until September 2022 the BSP retired and defaced or otherwise destroyed 519.93 metric tons of “unfit, demonetized, mutilated, and counterfeit coins.” According to central bank information, 70 percent or 364 metric tons were unfit coins; 25 percent or 128 metric tons were mutilated; four percent or 21 metric tons were counterfeit; and one percent or 7 metric tons were demonetized.

Shortages of circulating currency led the central bank to issue a statement during 2022 reading, “To reinforce its continuing efforts to maintain and protect the integrity of Philippine currency, the BSP is also seeking the enactment of a law defining and penalizing the excessive and unnecessary hoarding of coins.”

The government introduced automated coin deposit machines in August 2022 as a scheme to promote the recirculation of coins and persuade Filipinos to use the low-value currency in daily transactions.

In a further effort to ensure there is sufficient coinage in circulation the BSP has been reviewing if the 20-peso coin should be allowed to exceed the 1,000-peso limit at which it is now considered to be legal tender in cash transactions.